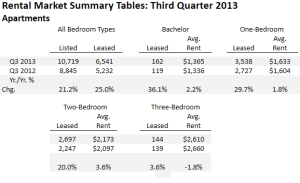

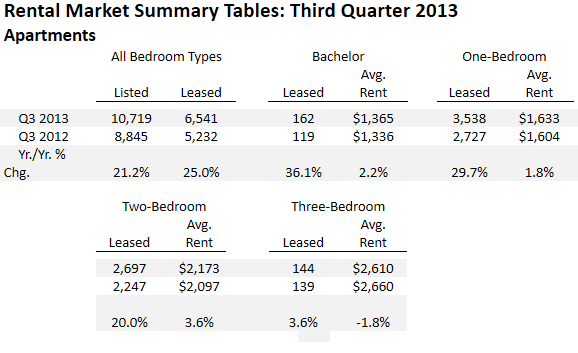

Greater Toronto Area REALTORS® reported 6,541 condominium apartments rented through the TorontoMLS system in the third quarter of 2013. This result was up by 25 per cent in comparison to the third quarter of 2012. The number of condominium apartments listed for rent on the TorontoMLS system during the third quarter was up by 21 per cent year-over-year to 10,719.

Approximately 80 per cent of condominium apartment rental transactions took place in the City of Toronto. In addition, there was a substantial number of rentals reported in parts of Peel Region and York Region.

“Almost one-third of GTA households rent the home in which they live. Given that we have experienced sustained population growth in the region, it makes sense that rental transactions have been increasing as well. Investor-owned condominium apartments are popular because of the modern finishes and amenities offered by many of these properties,” said Toronto Real Estate Board President Dianne Usher.

Third quarter average rents were up for one-bedroom and two-bedroom condominium apartments by 1.8 per cent and 3.6 per cent respectively on an annual basis.

“Competition between renters for available units increased in the third quarter. This is why we continued to see year-over-year growth in average rents for the popular one-bedroom and two-bedroom unit types,” said Jason Mercer, the Toronto Real Estate Board’s Senior Manager of Market Analysis.

© - Sabrina Silaphet

© - Sabrina Silaphet