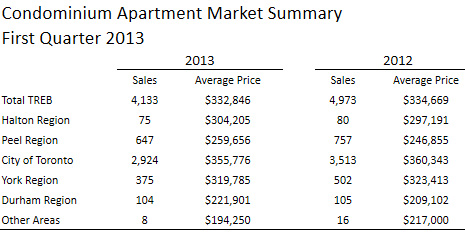

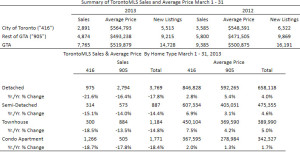

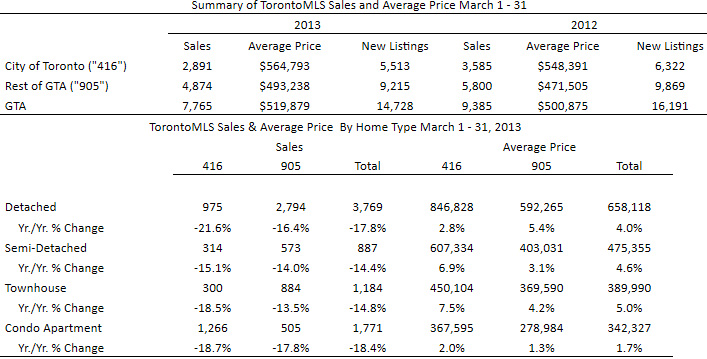

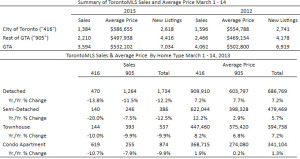

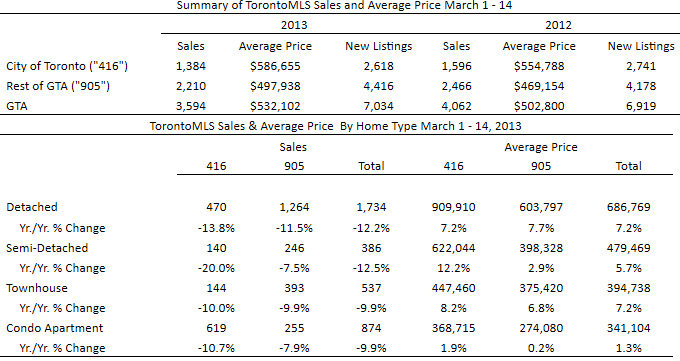

Greater Toronto Area REALTORS® reported 4,133 condominium apartment sales through the TorontoMLS system during the first quarter of 2013. This result was down by approximately 17 per cent in comparison to the first quarter of 2012.

New listings of condominium apartments were also down on a year-over-basis in the first quarter, but by a lesser annual rate of five per cent.

“Buyers benefitted from a substantial amount of choice in the condo market in the first quarter, especially in comparison to low-rise home types. This being said, the fact that new condo listings were down in the first quarter suggests that the market may become tighter moving forward. This will also depend on the timing and scale of future condo apartment completions,” said Toronto Real Estate Board President Ann Hannah.

The average price for first quarter condominium apartment sales was $332,846 – down by 0.5 per cent compared to the same period in 2012.

“With months of inventory high from a historic perspective, it makes sense that the average selling price for condos edged lower over the past two quarters. However, March results were much more positive compared to the first quarter as a whole, with the average condo selling price up by two per cent annually for the GTA,” said Jason Mercer, TREB’s Senior Manager of Market Analysis.

© - Sabrina Silaphet

© - Sabrina Silaphet