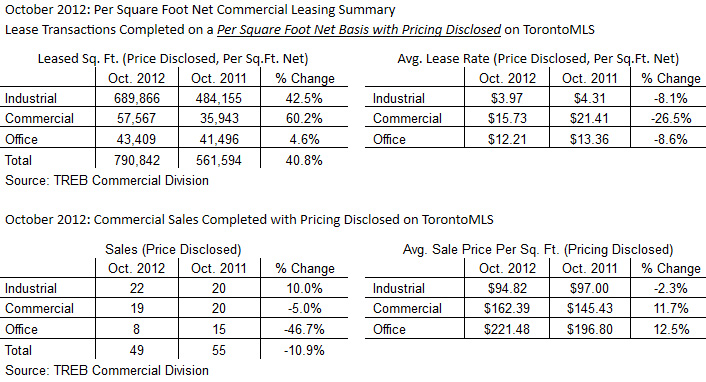

Toronto Real Estate Board (TREB) Commercial Division Members reported almost 791,000 square feet of leased commercial space in October 2012 (calculated for transactions completed on a per square foot net basis for which pricing was disclosed). This represented a 41 per cent increase compared to October 2011.

Following the historic norm for commercial transactions through the TorontoMLS system, industrial lease agreements accounted for 87 per cent of lease transactions on a square foot basis. The average industrial lease rate was $3.97 per square foot net – down by eight per cent compared to the average rate reported for October 2011.

“I am cautiously optimistic about the fact that overall lease transactions through the TorontoMLS system were up year-over-year in October. Business investment has been and is forecast to continue to be a major driver of Canadian economic growth. It makes sense that some of this investment has and will be pointed toward the commercial real estate market in the Greater Toronto Area,” said TREB Commercial Division Chair Cynthia Lai.

“It is likely that we will continue to see some volatility in monthly commercial transactions. Economic growth in Canada is still being constrained by global economic difficulties, which have acted as a drag on the Canadian export sector. As a result, manufacturing output remains below the pre-recession peak, which remains an issue for the industrial real estate market,” continued Lai.

The number of commercial sales in October was down by almost 11 per cent year-over-year to 49. Sales of industrial properties were up compared to October 2011, but this increase was more than offset by declines in commercial/retail and office transactions.

Annual growth in average selling prices per square foot (for transactions where pricing was disclosed) was mixed. The average industrial selling price was down, whereas average commercial/retail and office prices were up compared to October 2011. Price growth can be effected by changing market conditions as well as differences in the mix of properties sold in one year versus the next.

© - Sabrina Silaphet

© - Sabrina Silaphet

Leave a Reply