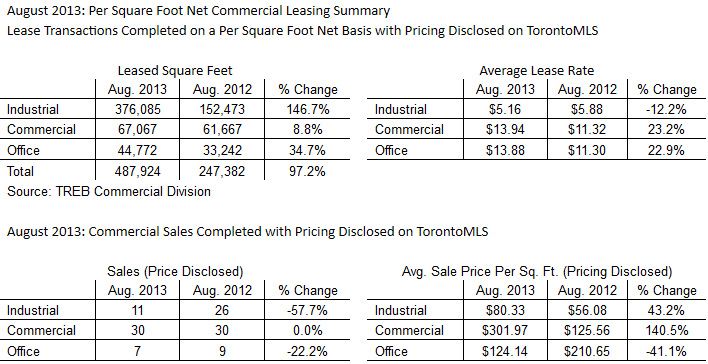

Toronto Real Estate Board Commercial Division Members reported almost 488,000 square feet of leased space through the TorontoMLS system in August 2013. This result represented a substantial increase over the 247,382 square feet of space leased during the same period in 2012. The industrial segment accounted for 77 per cent of the total space leased.

Year-over-year growth in average lease rates, for transactions undertaken on a per square foot net basis for which pricing was disclosed, was mixed. The average industrial lease rate was $5.16 in August 2013 – down from $5.88 in August 2012. Average lease rates for the commercial/retail and office market segments were up on a year-over-year basis.

“Over the last two months we have seen strong year-over-year growth in the amount of space leased through the TorontoMLS system. This growth has been driven by the industrial sector and suggests a strong result for the third quarter. The improvement in leasing activity seems to follow the view that overall economic growth in Canada is expected to improve in the second half of 2013 and even more so in 2014,” said Commercial Division Chair Cynthia Lai.

Combined sales of industrial, commercial/retail and office properties amounted to 48 in August 2013 – down from 65 transactions reported during the same period in 2012. Broken down by market segment, the number of commercial/retail transactions was the same as reported in 2012, whereas the number of industrial and office transactions was down.

Average selling prices, on a per square foot basis for transactions where pricing was disclosed, were up for industrial and commercial/retail transactions and down for office transactions. Year-over-year changes in average selling prices were strongly influenced by changes in the mix of properties sold this year versus last.

“The mix of industrial, commercial/retail and office transactions can change from one year to the next, on the basis of type, use and geography. These changes can result in fluctuations in the average selling price, especially when considering transactions on a monthly basis,” said Ms. Lai.

© - Sabrina Silaphet

© - Sabrina Silaphet

Leave a Reply