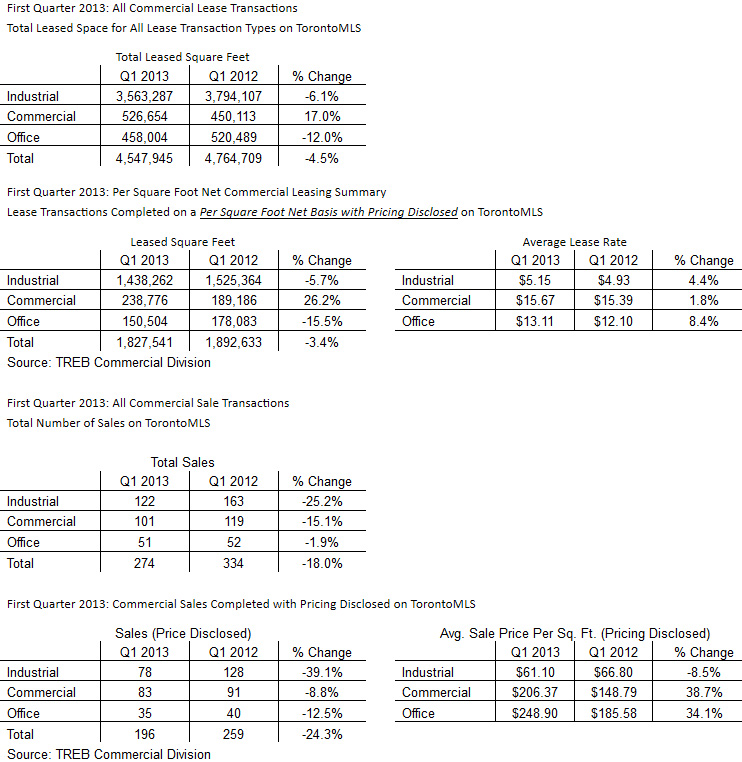

Toronto Real Estate Board Commercial Division Members reported 4,547,945 square feet of space leased through the TorontoMLS system in the first quarter of 2013. This represented a decrease of 4.5 per cent in comparison to Q1 2012. Leased industrial space – the key market segment for TorontoMLS leasing – amounted to 3,563,287 square feet, or 78 per cent of total leased space in Q1.

Average lease rates for transactions where pricing was disclosed were up on a year-over-year basis for all major property types. The average industrial lease rate was $5.15 per square foot net – up by 4.4 per cent compared to Q1 2012. Average lease rates for commercial/retail and office properties were up to $15.67 and $13.11 per square foot net respectively.

“Following a year-over-year dip in the fourth quarter of 2012, growth resumed for the average industrial lease rate, which was up by more than the rate of inflation in the first quarter of this year. While the outlook for the Canadian economy has been uncertain over the past year, the increase in the average industrial lease rate could be indicative of heightened demand for industrial space as some businesses anticipate an improvement in goods production and exports in 2013 and beyond,” said TREB Commercial Division Chair Cynthia Lai.

There was a total of 274 industrial, commercial/retail and office sales through the TorontoMLS system in Q1 2013. This sales total was down from 334 sales in Q1 2012. The average selling price per square foot for industrial transactions where pricing was disclosed was slightly lower, at $61.10 compared to $66.80 last year. The average selling prices for commercial/retail and office transactions were up on a year-over-year basis.

“Average selling prices do experience some volatility on a quarter-by-quarter basis, often due to a change in the types of properties being sold in different market segments. That being said, investment metrics for industrial properties in particular including surveyed cap rates and average prices from non-TorontoMLS sources suggest that pricing should remain buoyant this year. This is especially the case given that growth in the Canadian economy is expected to accelerate in 2013,” continued Lai.

© - Sabrina Silaphet

© - Sabrina Silaphet

Leave a Reply