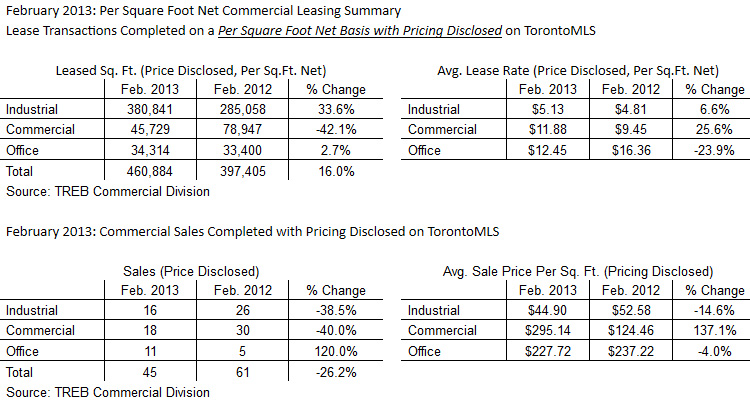

Toronto Real Estate Board (TREB) Commercial Division Members reported 460,884 total square feet of leased space through the TorontoMLS system in February (based on lease transactions for which pricing was disclosed). This result represented a year-over-year increase of 16 per cent in comparison to February 2012.

Industrial properties accounted for approximately 83 per cent of total lease transactions. The average industrial lease rate associated with February transactions was $5.13 per square foot net – up by more than 6.5 per cent compared to February 2012.

“It is a positive sign to see that both the industrial square footage leased and the average industrial lease rate was up in February. I am cautiously optimistic, but we will likely continue to see some volatility in the number and size of transactions from month to month. Economic growth in Canada continues to trend below average and economic uncertainty persists south of the border,” said TREB Commercial Division Chair Cynthia Lai.

Combined sales of industrial, commercial/retail and office properties were down in February compared to the same period last year. By market segment, industrial and commercial/retail transactions were down, but these declines were partially offset by an increase in office transactions.

Average selling prices, for transactions where pricing was disclosed, were down for industrial and office properties, while there was a large spike in the average price for commercial/retail properties. This large commercial/retail price increase was largely compositional in nature. In February 2012, the great majority of transactions involved larger properties which generally sell at a lower price per square foot. In comparison, February 2013 commercial/retail transactions involved an increased share of smaller properties, which resulted in a substantially higher average selling price this year.

“While the latest Gross Domestic Product growth results dealing with the fourth quarter of 2012 were below average, it was encouraging to note that business investment was up, including outlays on non-residential buildings. I am hopeful that this increased investment will translate into more transactions as we move through 2013,” continued Lai.

© - Sabrina Silaphet

© - Sabrina Silaphet

Leave a Reply