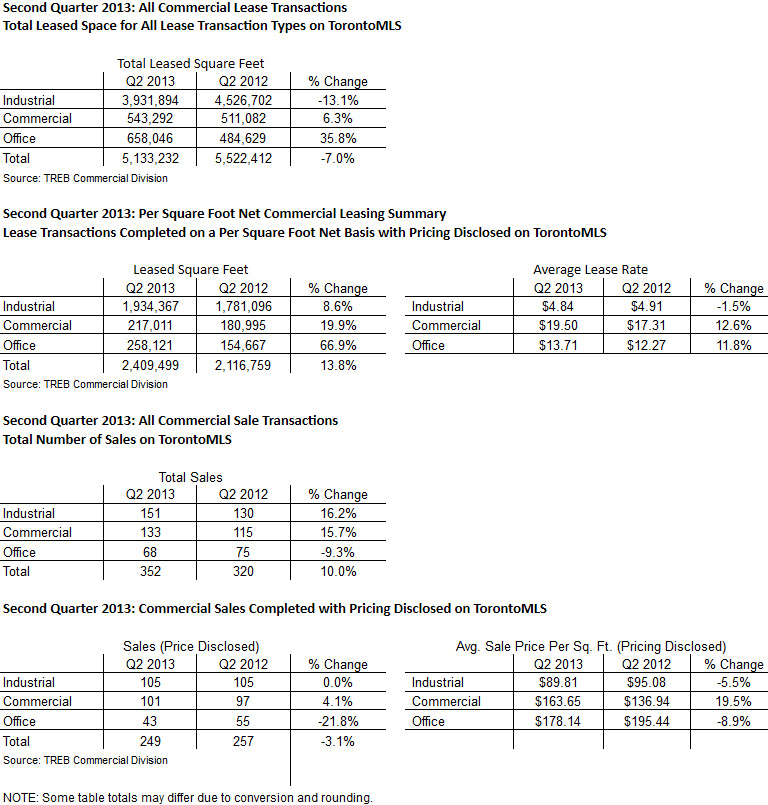

Toronto Real Estate Board Commercial Division Members reported over 5.1 million square feet of industrial, commercial/retail and office space leased through the TorontoMLS system in the second quarter of 2013. This result, which was down by seven per cent on a year-over-year basis, included approximately 3.9 million square feet of industrial space, accounting for slightly more than three-quarters of total leasing activity in the quarter.

Changes in average lease rates reported for transactions undertaken on a per square foot net basis, and for which pricing was disclosed, were mixed. The average industrial lease rate was down slightly on a year-over-year basis, whereas average lease rates for commercial/retail and office space were up over the same period.

“The industrial leasing market in the Greater Toronto Area, which accounts for the majority of leasing transactions on TorontoMLS, is driven by the export sector of the economy and, in particular, by the production of goods and services destined for the United States,” said TREB Commercial Division Chair Cynthia Lai. “We did see a welcome uptick in exports in the first quarter of 2013 and the consensus expectation is that exports will continue to climb back and eventually above the pre-recession peak. This will obviously bode well for investment in industrial real estate moving forward.”

“The commercial/retail and office markets performed well, with growth in the amount of leased space in the second quarter. This increased demand appears to have translated into tighter market conditions and growth in average lease rates,” continued Ms. Lai.

The total number of sales for industrial, commercial/retail and office properties through the TorontoMLS system in the second quarter was up by 10 per cent year-over-year to 352. Over the same period, average selling prices per square foot, for transactions where pricing was disclosed, were down for industrial and office properties and up for commercial/retail properties.

“Given that growth in business investment is expected to continue this year and next, it is reasonable to assume that purchases of industrial, commercial/retail and office properties will also increase, as businesses look to increase space and investors seek to take advantage of quality returns,” added Ms. Lai.

© - Sabrina Silaphet

© - Sabrina Silaphet

Leave a Reply