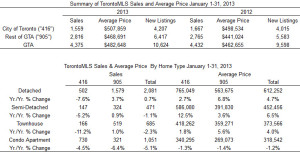

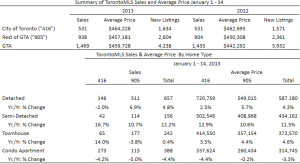

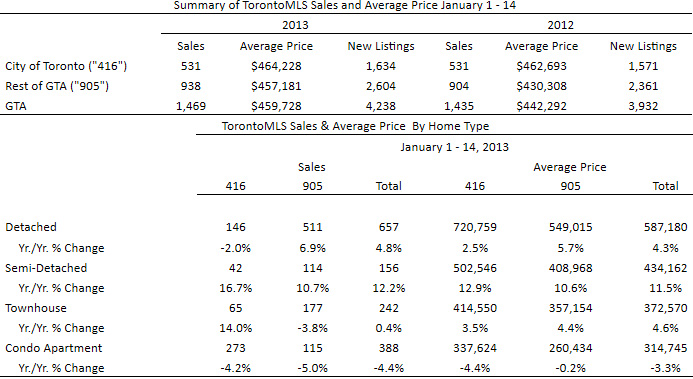

According to the Toronto Real Estate Board (TREB), over 4,375 homes sold within the GTA in the month of January 2013 which means, in the not so distant future, buyers in the city will be closing their deals and moving into their newly purchased homes. In an effort to make the moving process a little easier for the thousands of Torontonians moving each month, Toronto Hydro-Electric System Limited (Toronto Hydro) has launched My TorontoHydroTM – a new online tool to help customers manage their accounts.

My TorontoHydro gives customers fast and secure access to bills, payment history, account details and more. Customers can perform account moves online, 24 hours-a-day from the comfort of their homes.

To better serve new and existing homeowners, Toronto Hydro has teamed up with TREB to create a new Homeowners Kit, which will provide REALTORS® and their clients with information about key programs and services available through Toronto Hydro. From annual coupons and heating and cooling incentives to the fridge and freezer pick-up program, the Homeowners Kit will be a go-to resource for REALTORS® and their clients.

My TorontoHydro online tool is available at www.torontohydro.com and the Homeowners Kit is also available through TorontoMLS® System and TREB’s public website www.TorontoRealEstateBoard.com under “Hot Consumer Topics/Homeownership.” To view a copy of this kit immediately, click here.

In 2011, Toronto Hydro received over 200,000 move requests. The majority of these requests were processed by phone (107,295) or by mail/fax (81,700). With My TorontoHydro, customers can now complete their move in minutes at their leisure – no forms to mail, no phone calls to make.

In addition to performing moves online, customers that register for My TorontoHydro can:

- Manage accounts wherever they are;

- Get account details immediately;

- See bills at a glance;

- Arrange for ‘set-it-and-forget-it’ payments; and

- Complete landlord requests for unit consumption records.

QUOTES

“We are excited about the launch of this new tool that will provide customers the choice and convenience they expect.”

“Working with TREB for the launch of My TorontoHydro is a great opportunity for us to reach customers in an entirely new way and we look forward to a long and successful relationship.”

–Chris Tyrrell, Vice President, Customer Care and Chief Conservation Officer, Toronto Hydro.

“As the primary professional resource for Greater Toronto Area REALTORS®, TREB strives to find new and innovative ways to provide added value to our members.”

“This program with Toronto Hydro will help our REALTORS® continue to provide the cutting-edge service their clients expect.”

– Ann Hannah, TREB President.

About Toronto Hydro

The principal business of the Corporation and its subsidiaries is the distribution of electricity by Toronto Hydro-Electric System Limited. Toronto Hydro-Electric System owns and operates an electricity distribution system, which delivers electricity to approximately 712,000 customers located in the City of Toronto. It is the largest municipal electricity distribution company in Canada and distributes approximately 18% of the electricity consumed in the Province of Ontario.

Twitter – twitter.com/torontohydro

Facebook – facebook.com/torontohydro

YouTube – youtube.com/torontohydro

About the Toronto Real Estate Board

Greater Toronto REALTORS® are passionate about their work. They adhere to a strict Code of Ethics and share a state-of-the-art Multiple Listing Service. Serving over 36,000 Members in the Greater Toronto Area, the Toronto Real Estate Board is Canada’s largest real estate board. Greater Toronto Area open house listings are available on www.TorontoRealEstateBoard.com

For more information:

Tanya Bruckmueller, Toronto Hydro-Electric System

Tbruckmueller@torontohydro.com

W: 416-542-2621

C: 416-903-0440

Mary Gallagher, Toronto Real Estate Board

W: 416-443-8158

© - Sabrina Silaphet

© - Sabrina Silaphet