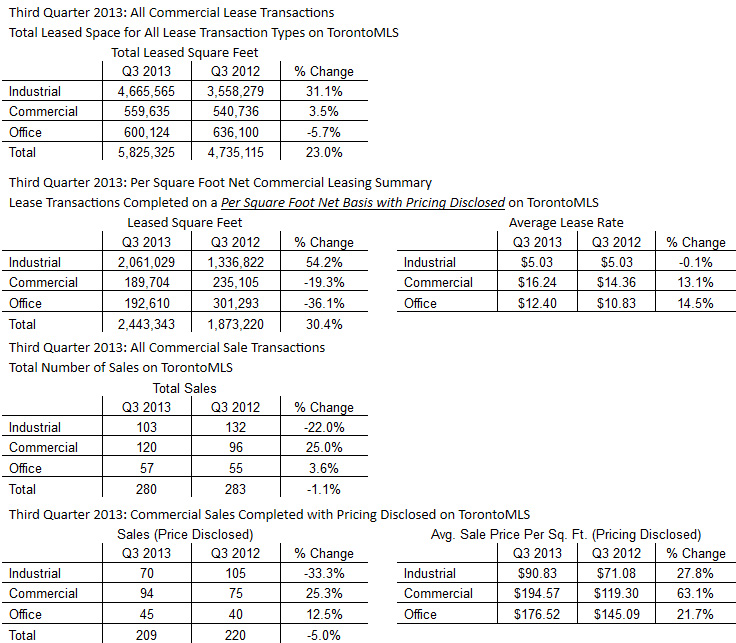

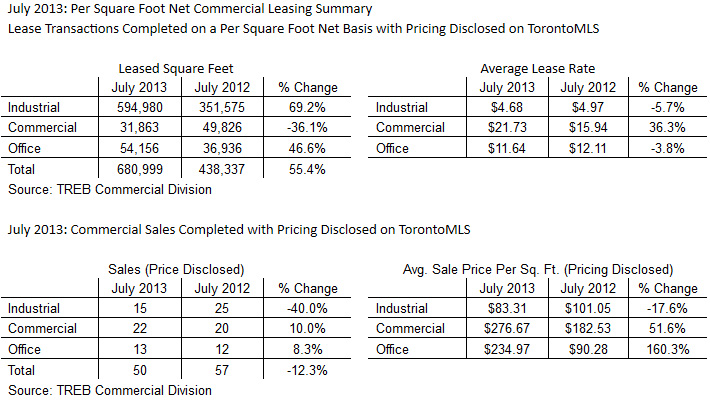

Toronto Real Estate Board Commercial Division Members reported over 5.8 million square feet of leased space in the third quarter of 2013. This result was up by 23 per cent in comparison to approximately 4.7 million square feet leased in the third quarter of 2012. The increase in leased space was driven by a surge in industrial leasing activity, with the amount of leased industrial space up by 31 per cent on a year-over-year basis to over 4.6 million square feet. Industrial space accounted for 80 per cent of total space leased.

The third quarter 2013 average lease rate for industrial properties transacted on a per square foot net basis, where pricing was disclosed, was unchanged compared to the same period in 2012, at $5.03. The average commercial/retail and office per square foot net lease rates were up by 13.1 per cent and 14.5 per cent to $16.24 and $12.40 respectively on a year-over-year basis.

“The annual growth in the amount of space leased in the third quarter, particularly in the industrial market segment, suggests that businesses in the Greater Toronto Area are expecting stronger growth over the next year. In anticipation of more robust economic activity, many of these businesses have taken on more space in order to account for increased demand for their goods or services moving forward,” said TREB Commercial Division Chair Cynthia Lai.

Combined industrial, commercial/retail and office property sales in the third quarter of 2013, at 280, were almost unchanged compared to 283 sales reported during the third quarter of 2012. The strongest sales growth was experienced in the commercial/retail market segment, with the number of deals up by 25 per cent year-over-year.

Average selling prices reported on a per square foot basis, for transactions with pricing disclosed, were up on a year-over-year basis for all major property types.

“Two factors arguably contributed to the average annual sale price increases experienced in the third quarter. First, an increase in demand for some property types in some areas of the GTA, particularly in the commercial/retail and office segments where sales were up, likely played a role. Second, there was a change in the geography and size of properties sold this year compared to last. For example, this year there was a higher percentage of smaller commercial/retail properties sold. All else being equal, smaller properties tend to sell for more on a per square foot basis than larger properties,” continued Ms. Lai.

© - Sabrina Silaphet

© - Sabrina Silaphet